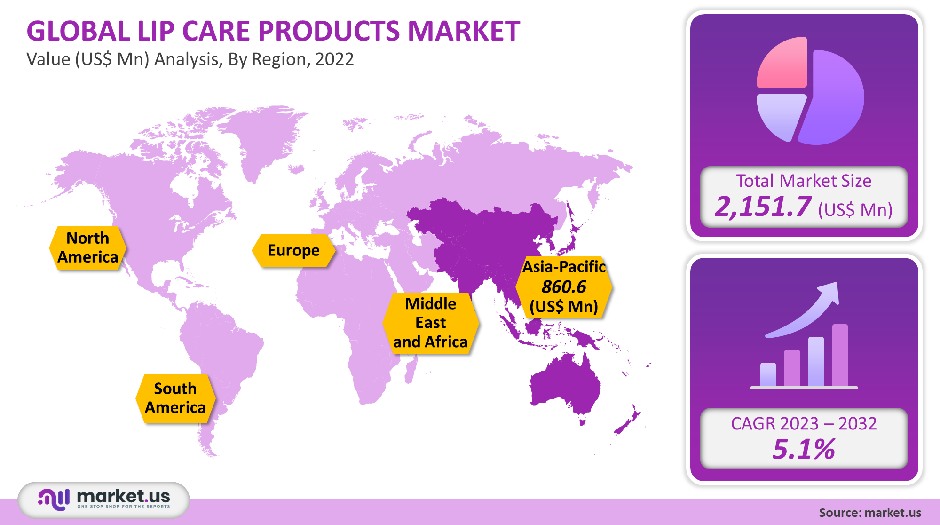

Globally, the market for lip care products was worth USD 2,151.7 million in 2021. It is projected to grow at a CAGR, of 5.1% between 2023-2032.

There is a growing demand for high-quality products due to concerns about sun damage, dryness, and darkening of the lips. As consumers seek safer alternatives to toxic and synthetic chemicals, organic and natural lip balms have been gaining in popularity.

This is due to the increasing popularity of wellness and personal grooming, which has led more men to use these products. Sales of lip care and beauty products via major offline retailers have been greatly affected by the COVID-19 pandemic.

In 2021, lip balms accounted for 50% of revenue. This share is expected to continue over the forecast period. Major players have increased the number of product launches to attract a wider customer base. This has contributed to the growth of this segment. Estee Lauder Companies Inc., for instance, launched its lip care range in February. It includes lip balm, potion, and lip gloss.

However, the CAGR for the other segment, which encompasses various types of lip balms, oils, and masks, is expected to grow at the fastest pace during the forecast period. Innovative products are gaining consumers’ attention, which is driving the other segment. Consumers are becoming increasingly fond of collagen and gel-based lip masks. It is predicted that the lip scrub market will grow steadily between 2023 and 2032. Lip scrubs are becoming more popular due to their ability to remove dead cells and exfoliate the skin.

A high revenue share was held by hypermarkets & supermarkets in 2021. It is expected to continue its leadership position for the duration of the forecast period. These stores are a great option for customers because they offer low prices and high visibility of both international and local brands.

The fastest CAGR is expected to be recorded in the specialty stores channel segment during the forecast period. Because of their ease of purchasing, large network, and the availability of a limited range of products at affordable prices, consumers choose specialty stores. These stores can also offer niche items such as organic, cruelty-free, natural, and vegan products.

Online sales are expected to grow at the second-fastest rate between 2023 and 2032. The forecast period will see an increase in online product sales. Anastasia Beverly Hills, Amazon, Kinship Inc., Sephora, and Walmart are among the top online retailers of lip products. The COVID-19 epidemic has led to an increase in sales through eCommerce. This has positively impacted segment growth.

Many mass-market stores, brick and mortar stores, as well as other retailers, reported a drop in sales for the same year. The Boots Company PLC for instance reported a drop in beauty product sales by 2/3 between March 2020 and April 2020. But, DIY and self-care beauty products are a growing trend in the market. This trend is expected to rebound during the forecast period.

Due to increasing demand, these products are rapidly growing in the U.S. because consumers are choosing organic products due to their shifting preference for vegan products. Many lip care companies in the region are now focusing on sustainable production due to growing concerns about plastic reduction and waste disposal. Ethique Inc., for instance, introduced a new line of lip balms to the U.S. in June 2021. The product uses plant-derived ingredients that are 100% biodegradable and plastic-free.

According to the U.S. PIRG article, close to 80% of women use lip-care products and 40% of men do so. American women use lip care products more often than American men. These products are applied on average by American women up to 2.35x per day. This could exceed 15 times per day. These indicators suggest a positive outlook for America’s market in the coming years.

Due to the increased popularity of lip care, self-care, and lip scrubs among women, many international and regional producers are now offering unique lip balms, scrubs, and masks. They are becoming more popular because of the increasing availability of organic, tinted, and natural lip balms at a lower price.

The market leaders are investing in research and development to create premium, skin-friendly products for lip care. Natural and organic lip care treatments that do not contain aluminum or sodium Laureth sulfate are seeing significant growth. Anastasia Beverly Hills launched vegan and cruelty-free lip balms in varieties like mango, strawberry, and coconut. Market growth is expected to be positive if such product offerings are made.

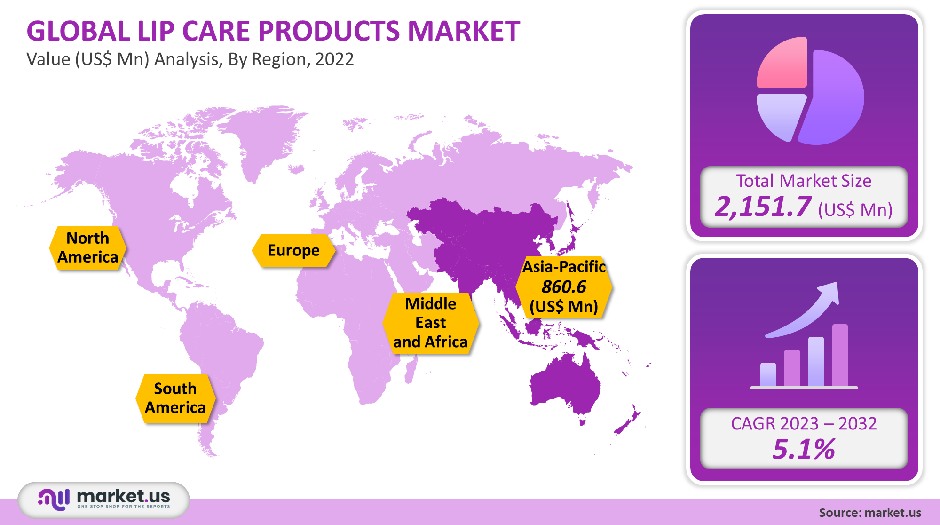

The Asia Pacific had a greater revenue share of 40% in 2021. The region is forecast to maintain its leading position and grow at the fastest CAGR for the forecast period. Consumers are becoming more sensitive to the sun, and experiencing issues such as lip coloration and darkening, in particular in India. This is increasing demand for these products. Europe is expected to be the second largest regional market.

Central & South America is projected for the second-fastest CAGR, from 2023-2032. To reach new customer segments, Central & South American manufacturers are working to develop lip care products that include a mix of organic and natural ingredients.

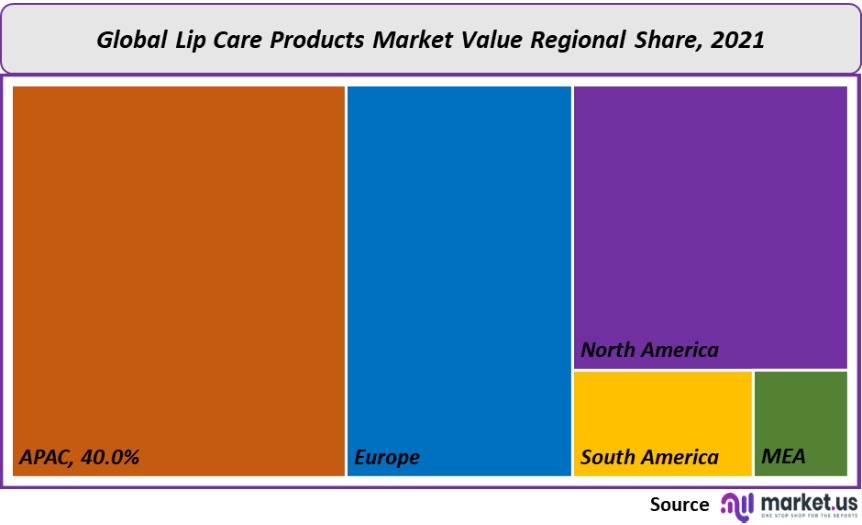

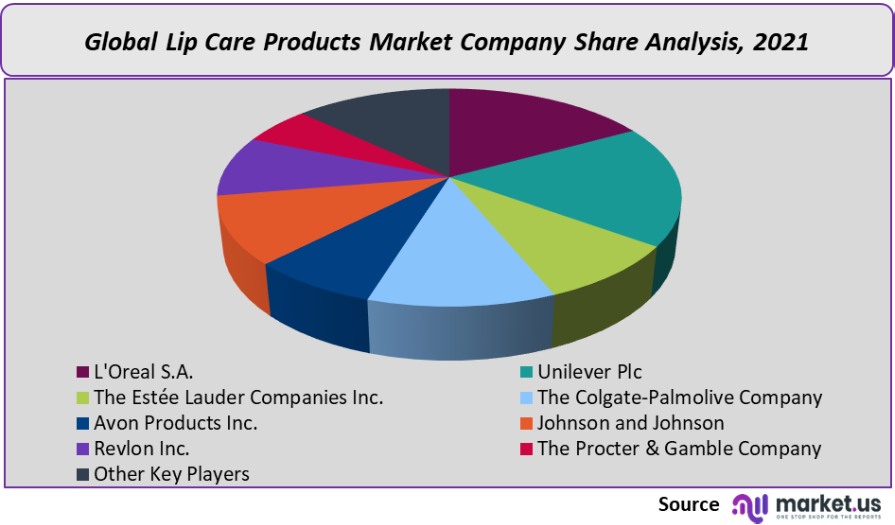

The market is dominated by a few well-established players and new entrants. To increase their product offerings, broaden their consumer base, and gain an edge over other players, market players are focusing on product launches. Summer Fridays launched a new range of lip butter balms in May 2021. They are now available for purchase on retail websites such as Revolve and Sephora.

For the Lip Care Products Market research study, the following years have been considered to estimate the market size: