![[OPINION] Train law: What does it change?](https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/CC35DB38E6F04870AE8D36C70DBEEEDB/thought-leaders-edward-gialogo.jpg?resize=200%2C200&zoom=1)

Already have Rappler+?

Sign in to listen to groundbreaking journalism.

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[OPINION] Train law: What does it change?](https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/CC35DB38E6F04870AE8D36C70DBEEEDB/thought-leaders-edward-gialogo.jpg?resize=200%2C200&zoom=1)

As a tax lawyer, I noticed that there are a lot of news reports on the changes. But actually, there are much more significant changes under the Train law which are not being reported.

As we celebrated the New Year, the Tax Reform for Acceleration and Inclusion (Train) Law or Republic Act No 10963 took effect on January 1, 2018. Train overhauls the outdated National Internal Revenue Code (NIRC) which was adopted 20 years ago.

As a tax lawyer, I noticed that there are a lot of news reports on the changes. But actually, there are much more significant changes under the Train law which are not being reported.

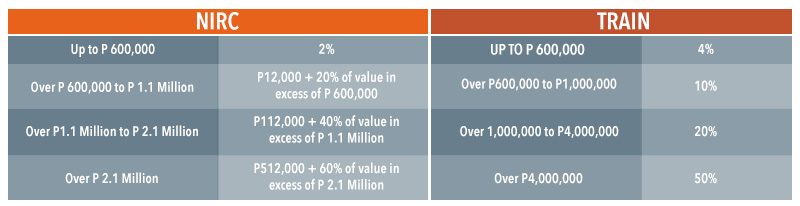

Train relatively decreases the tax on personal income, estate, and donation. However, it also increases the tax on certain passive incomes, documents (documentary stamp tax) as well as excise tax on petroleum products, minerals, automobiles, and cigarettes.

The Train law also imposes new taxes in the form of excise tax on sweetened beverages and non-essential services (invasive cosmetic procedures) and removes the tax exemption of Lotto and other PCSO winnings amounting to more than P10,000.

Nonetheless, the new law also contains praiseworthy provisions which aim to simplify tax compliance.

Reduced taxes

Personal Income Tax

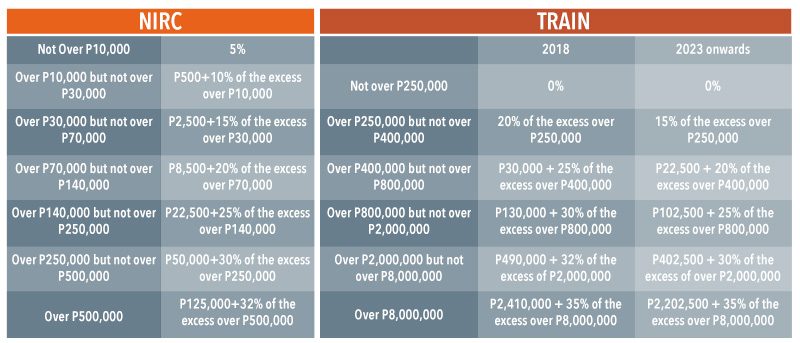

The most popular part of the Train law is the reduction of personal income tax of a majority of individual taxpayers. Prior to the enactment of the new law, an individual employee or self-employed taxpayer would normally have to pay income tax at the rate of 5% to 32%, depending on one’s bracket.

Under Train, an individual with a taxable income of P250,000 or less will now be exempt from income tax. Those with a taxable income of above P250,000 will be subject to the rate of 20% to 35% effective 2018, and 15% to 35% effective 2023. Moreover, the deductible 13th month pay and other benefits are now higher at P90,000 compared to P82,000 under the old law.

The table shows the comparison of the brackets and tax rates under the NIRC and Train:

Another innovation under Train is the option of self-employed individuals and/or professionals whose gross sales or receipts do not exceed P3,000,000 to avail of an 8% tax on gross sales or gross receipts in excess of P250,000, in lieu of the graduated income tax rates.

It is not being highlighted, however, that some items that were previously deducted to arrive at taxable income had been removed under Train. These are the personal exemption of P50,000, additional exemption of P25,000 per dependent child, and the premium for health and hospitalization insurance of P2,400 per year.

The estate tax rate was also changed from 5% to 32% of the net estate to a flat rate of 6%. Additionally, the following deductions allowed in computing the net estate (to be subjected to estate tax) were increased:

The donor’s tax rate was also amended to a single rate of 6% regardless of the relationship between the donor and the donee. In the old law, the rates of donor’s tax were 2% to 15% if the donor and donee are related, and 30% if otherwise. However, the donation of real property is now subject to Documentary Stamp Tax of P15 for every P1,000.

Value Added Tax

There are also amendments to VAT which lessen the burden of taxpayers:

Increased taxes

Train imposes higher taxes on some passive incomes, including interest income from dollar and other foreign currency deposits.

There is also a significant increase in the tax on sale of shares of stocks.

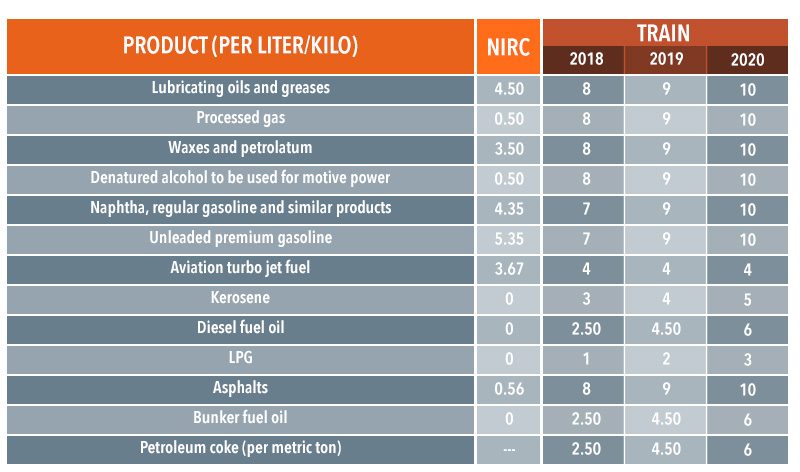

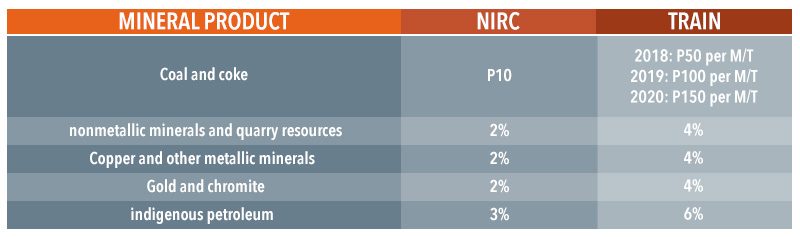

Train imposes higher excise taxes on cigarettes, manufactured oils (petroleum products), mineral products and automobiles.

Manufactured oils and other products

Hybrid vehicles shall be subject to 50% of the applicable excise tax rates. But purely electric vehicles and pick-ups shall be exempt from excise tax.

Documentary Stamp Tax

Unlike the House of Representatives’ version of Train wherein no change was introduced on the rates of Documentary Stamp Taxes (DST), Train increases the DST on almost all taxable documents.

New taxes

Aside from increase and decrease of certain taxes, Train also introduces new taxes in the form of excise tax on sweetened beverages and non-essential services.

Invasive cosmetic procedures directed solely towards improving, altering, or enhancing the patient’s appearance is now subject to excise tax of 5%.

Previously, PCSO winnings, regardless of amount, were exempt from tax. Train subjects PCSO winnings to a 20% final withholding tax if the amount is more than P10,000.

Simplified tax compliance

Apparently, the Philippine tax system is a very complicated one. This was certainly considered by Congress when it enacted the Train law. Consequently, Train introduces amendments which are geared towards simpler tax compliance. Some of these amendments are:

With the enactment of the Train law, the government expects to generate more revenues to fund its “Build, Build, Build” projects and other programs. At the same time, the labor sector is expected to be freed from the burden of outdated and inequitable personal income tax. Hopefully, this benefit for the workers can still be achieved despite the increase in prices of some goods that they consume.

Read our law office’s comprehensive comparison of the NIRC and the Train law here. – Rappler.com

This article is for general information only. If you have any question or comment regarding this article, you may email the author at egialogo.gdlaw@gmail.com.

Atty Edward G. Gialogo is the managing partner of Gialogo Dela Fuente & Associates. He is also a tax speaker in Philippine Institute of Certified Public Accountants and Business Law Reviewer in Review School of Accountancy (ReSA). He was an Associate Director in the Tax Services of SyCip Gorres Velayo & Co.