Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

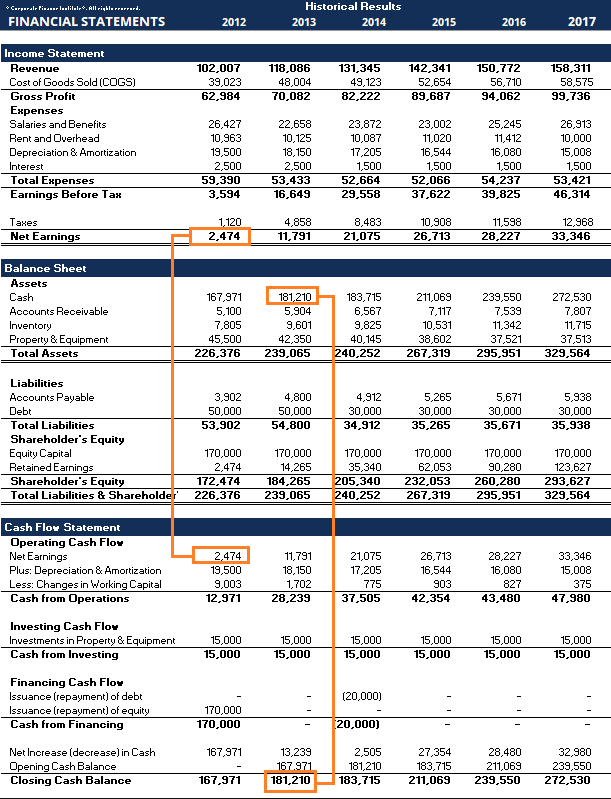

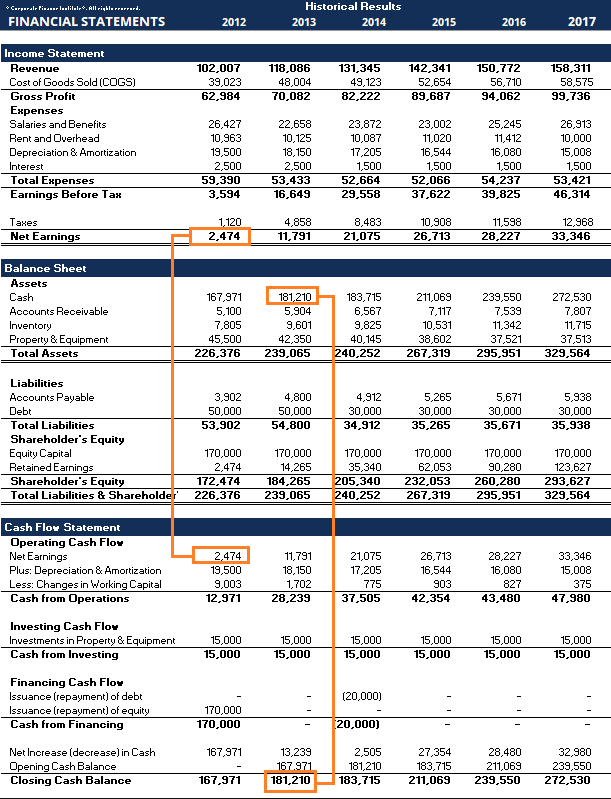

Financial statements are the records of a company’s financial condition and activities during a period of time. Financial statements show the financial performance and strength of a company. The three core financial statements are the income statement, balance sheet, and cash flow statement. The three statements are linked together to create the three statement financial model. The analysis of financial statements can help an analyst assess the profitability and liquidity of a company. Financial statements are complex. It is best to become familiar with them by looking at financial statements examples.

In this article, we will take a look at some financial statement examples from Amazon.com, Inc. for a more in-depth look at the accounts and line items presented on financial statements.

Learn to analyze financial statements with Corporate Finance Institute’s Reading Financial Statements course!

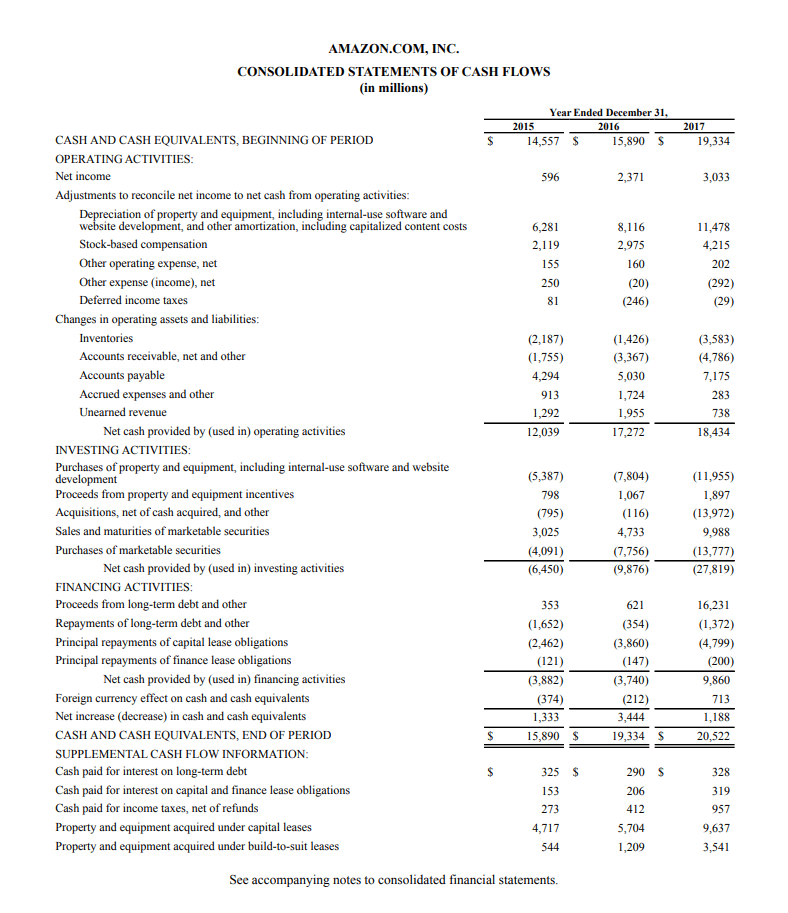

The first of our financial statements examples is the cash flow statement. The cash flow statement shows the changes in a company’s cash position during a fiscal period. The cash flow statement uses the net income figure from the income statement and adjusts it for non-cash expenses. This is done to find the change in cash from the beginning of the period to the end of the period.

Most companies begin their financial statements with the income statement. However, Amazon (NASDAQ: AMZN) begins its financial statements section in its annual 10-K report with its cash flow statement.

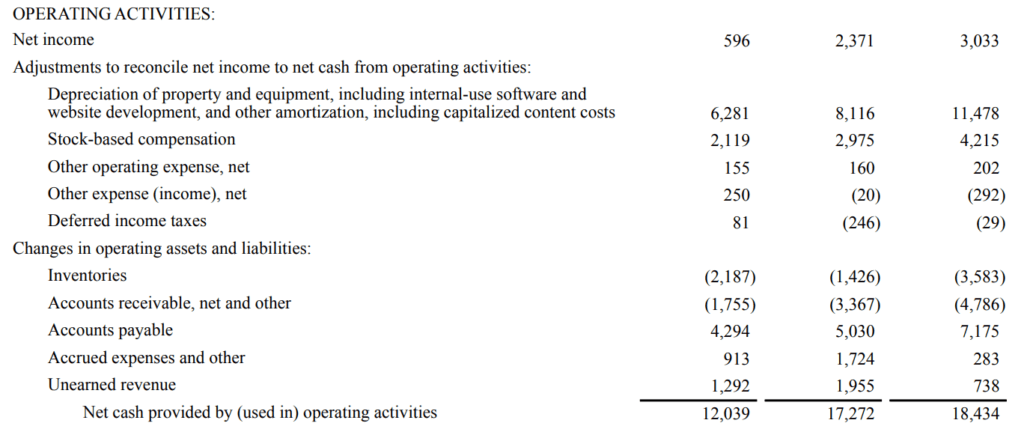

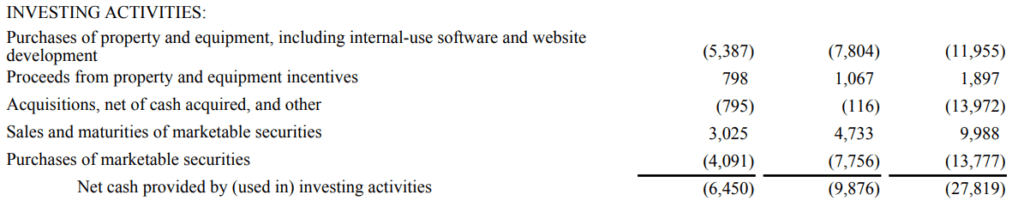

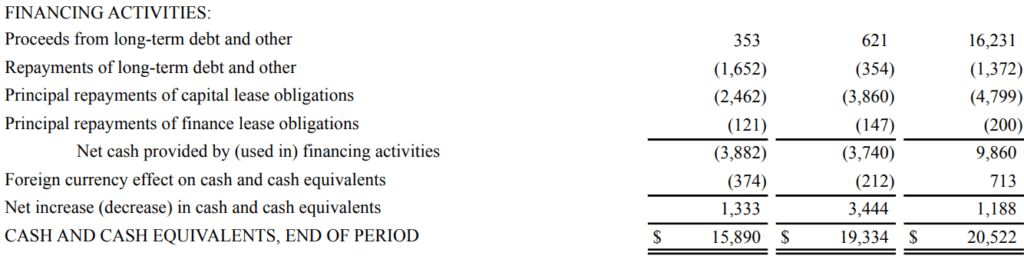

The cash flow statement begins with the net income and adjusts it for non-cash expenses, changes to balance sheet accounts, and other usages and receipts of cash. The adjustments are grouped under operating activities , investing activities , and financing activities .

The following are explanations for the line items listed in Amazon’s cash flow statement. Please note that certain items such as “Other operating expenses, net” are often defined differently by different companies:

Depreciation of property and equipment (…): a non-cash expense representing the deterioration of an asset (e.g. factory equipment).

Stock-based compensation: a non-cash expense as a company awards stock options or other stock-based forms of compensation to employees as part of their compensation and wage agreements.

Other operating expense, net: a non-cash expense primarily relating to the amortization of Amazon’s intangible assets.

Other expense (income), net: a non-cash expense relating to foreign currency and equity warrant valuations.

Deferred income taxes: temporary differences between book tax and actual income tax. The amount of tax the company pays may be different from what it shows on its financial statements.

Changes in operating assets and liabilities: non-cash changes in operating assets or liabilities. For example, an increase in accounts receivable is a sale or a source of income where no actual cash was received, thus resulting in a deduction. Conversely, an increase in accounts payable is a purchase or expense where no actual cash was used, resulting in an addition to net cash.

Purchases of property and equipment (…): purchases of plants, property, and equipment are usages of cash. A deduction from net cash.

Proceeds from property and equipment incentives: this line is added for additional detail on Amazon’s property and equipment purchases. Incentives received from property and equipment vendors are recorded as a reduction in Amazon’s costs and thus a reduction in cash usage.

Acquisitions, net of cash acquired, and other: cash used towards acquisitions of other companies, net of cash acquired as a result of the acquisition. A deduction from net cash.

Sales and maturities of marketable securities: the sale or proceeds obtained from holding marketable securities (short-term financial instruments that mature within a year) to maturity. An addition to net cash.

Purchases of marketable securities: the purchase of marketable securities. A deduction from net cash.

Proceeds from long-term debt and other: cash obtained from raising capital by issuing long-term debt. An addition to net cash.

Repayments of long-term debt and other: cash used to repay long-term debt obligations. A deduction from net cash.

Principal repayments of capital lease obligations: cash used to repay the principal amount of capital lease obligations. A deduction from net cash.

Principal repayments of finance lease obligations: cash used to repay the principal amount of finance lease obligations. A deduction from net cash.

Foreign currency effect on cash and cash equivalents: the effect of foreign exchange rates on cash held in foreign currencies.

Cash paid for interest on long-term debt: cash usages to pay accumulated interest from long-term debt.

Cash paid for interest on capital and finance lease obligations: cash usages to pay accumulated interest from capital and finance lease obligations.

Cash paid for income taxes, net of refunds: cash usages to pay income taxes.

Property and equipment acquired under capital leases: the value of property and equipment acquired under new capital leases in the fiscal period.

Property and equipment acquired under build-to-suit leases: the value of property and equipment acquired under new build-to-suit leases in the fiscal period.

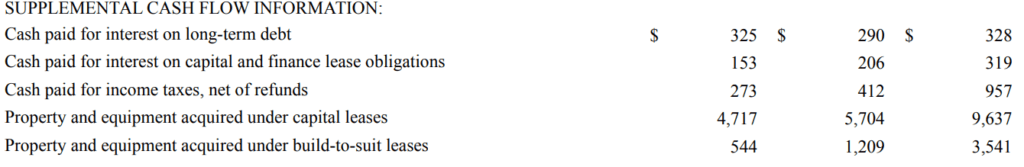

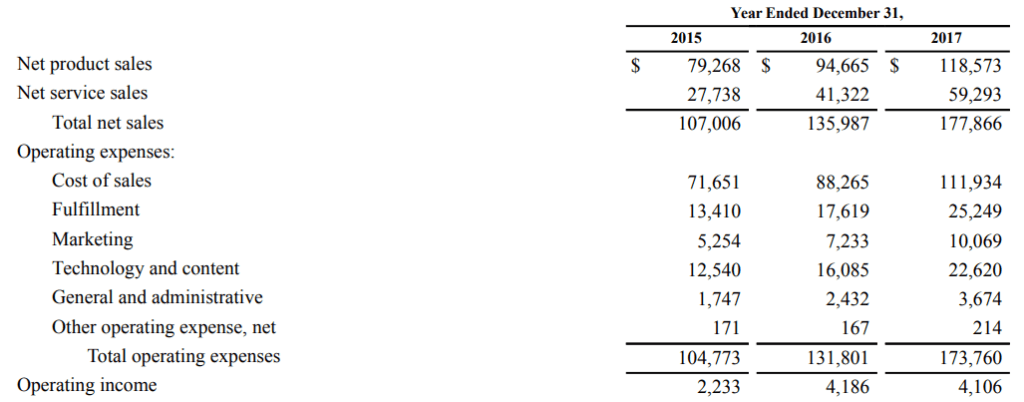

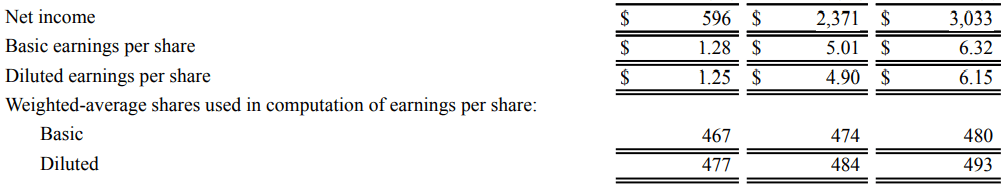

The next statement in our financial statements examples is the income statement. The income statement is the first place for an analyst to look at if they want to assess a company’s profitability.

Want to learn more about financial analysis and assessing a company’s profitability? Financial Modeling & Valuation Analyst (FMVA)® Certification Program will teach you everything you need to know to become a world-class financial analyst!

The income statement provides a look at a company’s financial performance throughout a certain period, usually a fiscal quarter or year. This period is usually denoted at the top of the statement, as can be seen above. The income statement contains information regarding sales, costs of sales, operating expenses, and other expenses.

The following are explanations for the line items listed in Amazon’s income statement:

Net product sales: revenue derived from Amazon’s product sales such as Amazon’s first-party retail sales and proprietary products (e.g., Amazon Echo)

Net services sales: revenue generated from the sale of Amazon’s services. This includes proceeds from Amazon Web Services (AWS), subscription services, etc.

Cost of sales: costs directly associated with the sale of Amazon products and services. For example, the cost of raw materials used to manufacture Amazon products is a cost of sales.

Fulfillment: expenses relating to Amazon’s fulfillment process. Amazon’s fulfillment process includes storing, picking, packing, shipping, and handling customer service for products.

Marketing: expenses pertaining to advertising and marketing for Amazon and its products and services. Marketing expense is often grouped with selling, general, and administrative expenses (SG&A) but Amazon has chosen to break it out as its own line item.

Technology and content: costs relating to operating Amazon’s AWS segment.

General and administrative: operating expenses that are not directly related to producing Amazon’s products or services. These expenses are sometimes referred to as non-manufacturing costs or overhead costs. These include rent, insurance, managerial salaries, utilities, and other similar expenses.

Other operating expenses, net: expenses primarily relating to the amortization of Amazon’s intangible assets.

Operating income: the income left over after all operating expenses (expenses directly related to the operation of the business) are deducted. Also known as EBIT.

Interest income: income generated by Amazon from investing excess cash. Amazon typically invests excess cash in investment-grade, short to intermediate-term fixed income securities, and AAA-rated money market funds.

Interest expense: expenses relating to accumulated interest from capital and finance lease obligations and long-term debt.

Other income (expense), net: income or expenses relating to foreign currency and equity warrant valuations.

Income before income taxes: Amazon’s income after operating and non-operating expenses have been deducted.

Provision for income taxes: the expense relating to the amount of income tax Amazon must pay within the fiscal year.

Equity-method investment activity, net of tax: proportionate losses or earnings from companies where Amazon owns a minority stake.

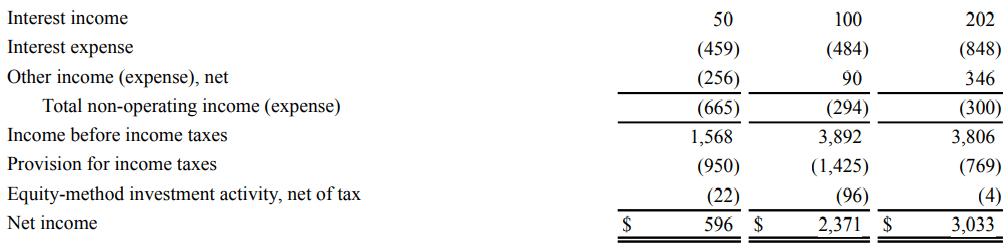

Net income: the amount of income left over after Amazon has paid off all its expenses.

Basic earnings per share: earnings per share calculated using the basic number of shares outstanding.

Diluted earnings per share: earnings per share calculated using the diluted number of shares outstanding.

Weighted-average shares used in the computation of earnings per share: a weighted average number of shares to account for new stock issuances throughout the year. The way the calculation works is by taking the weighted average number of shares outstanding during the fiscal period covered.

For example, a company has 100 shares outstanding at the beginning of the year. At the end of the first quarter, the company issues another 50 shares, bringing the total number of shares outstanding to 150. The calculation for the weighted average number of shares would look like below:

100*0.25 + 150*0.75 = 131.25

Basic: the number of shares outstanding in the market at the date of the financial statement.

Diluted: the number of shares outstanding if all convertible securities (e.g. convertible preferred stock, convertible bonds) are exercised.

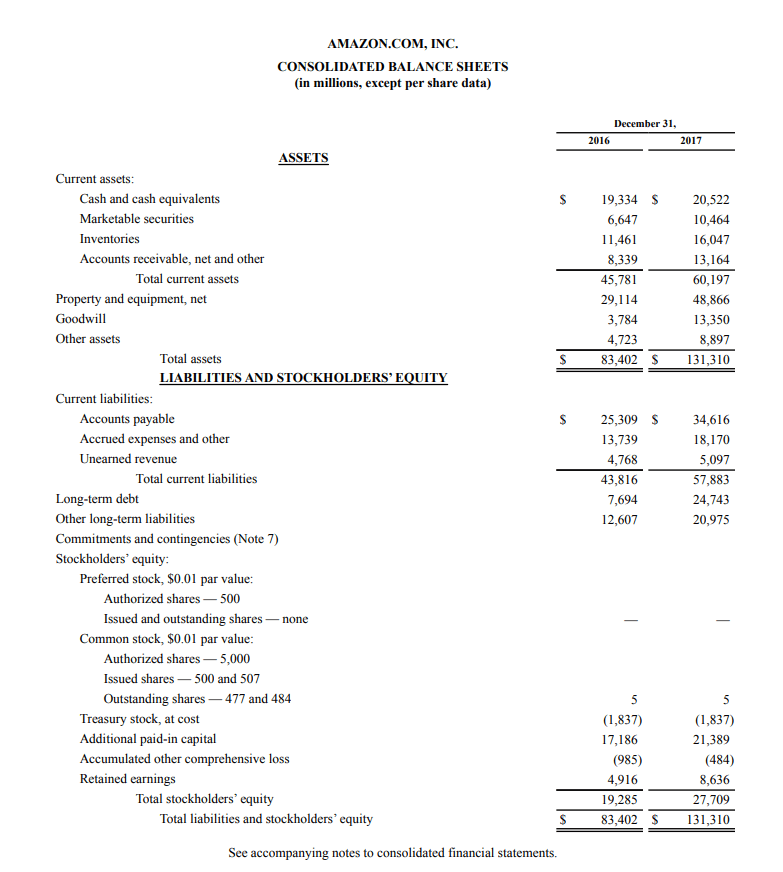

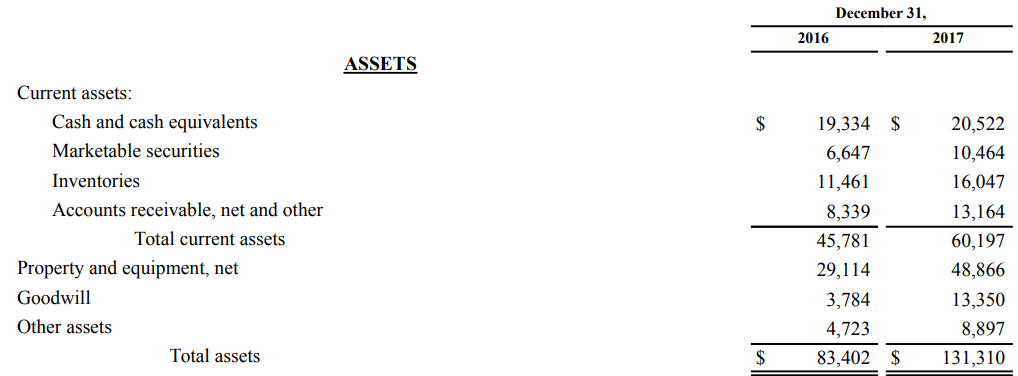

The last statement we will look at with our financial statements examples is the balance sheet. The balance sheet shows the company’s assets, liabilities, and stockholders’ equity at a specific point in time.

Learn how a world-class financial analyst uses these three financial statements with CFI’s Financial Modeling & Valuation Analyst (FMVA)® Certification Program!

Unlike the income statement and the cash flow statement, which display financial information for the company during a fiscal period, the balance sheet is a snapshot of the company’s finances at a specific point in time. It can be seen above in the line regarding the date.

Compared to the Cash Flow Statement and Statement of Income, it states ‘December 31, 2017’ as opposed to ‘Year Ended December 31, 2017’. By displaying snapshots from different periods, the balance sheet shows changes in the accounts of a company.

The following are explanations for the line items listed in Amazon’s balance sheet:

Cash and cash equivalents: cash or highly liquid assets and short-term commitments that can be quickly converted into cash.

Marketable securities: short-term financial instruments that mature within a year.

Inventories: goods currently held in stock for sale, in-process goods, and materials to be used in the production of goods or services.

Accounts receivable, net and other: credit sales of a business that have not yet been fully paid by customers.

Goodwill: the difference between the price paid in an acquisition of a company and the fair market value of the target company’s net assets.

Other assets: Amazon’s acquired intangible assets, net of amortization. This includes items such as video, music content, and long-term deferred tax assets.

Accounts payable: short-term liabilities incurred when Amazon purchases goods from suppliers on credit.

Accrued expenses and other: liabilities primarily related to Amazon’s unredeemed gift cards, leases and asset retirement obligations, current debt, acquired digital media content, etc.

Unearned revenue: revenue generated when payment is received for goods or services that have not yet been delivered or fulfilled. Unearned revenue is a result of revenue recognition principles outlined by U.S. GAAP and IFRS.

Long-term debt: the amount of outstanding debt a company holds that has a maturity of 12 months or longer.

Other long-term liabilities: Amazon’s other long-term liabilities, which include long-term capital and finance lease obligations, construction liabilities, tax contingencies, long-term deferred tax liabilities, etc. (Note 6 of Amazon’s 2017 annual report).

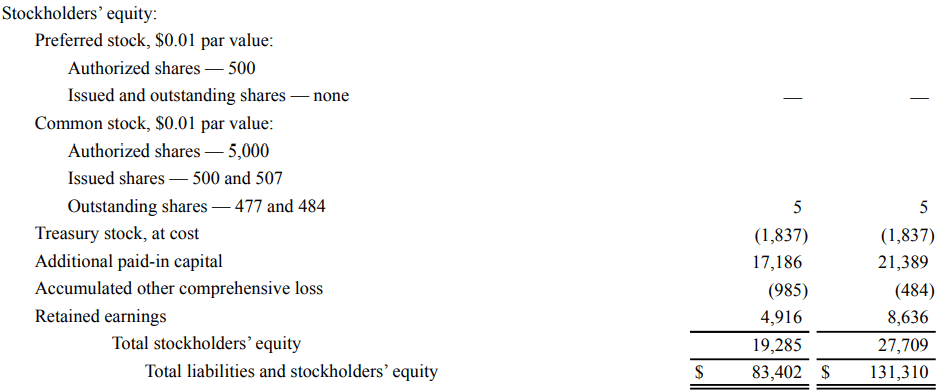

Preferred stock: stock issued by a corporation that represents ownership in the corporation. Preferred stockholders have a priority claim on the company’s assets and earnings over common stockholders. Preferred stockholders are prioritized with regard to dividends but do not have any voting rights in the corporation.

Common stock: stock issued by a corporation that represents ownership in the corporation. Common stockholders can participate in corporate decisions through voting.

Treasury stock, at cost: also known as reacquired stock, treasury stock represents outstanding shares that have been repurchased from the stockholder by the company.

Additional paid-in capital: the value of share capital above its stated par value in the above line item for common stock ($0.01 in the case of Amazon). In Amazon’s case, the value of its issued share capital is $17,186 million more than the par value of its common stock, which is worth $5 million.

Accumulated other comprehensive loss: accounts for foreign currency translation adjustments and unrealized gains and losses on available-for-sale/marketable securities.

Retained earnings: the portion of a company’s profits that is held for reinvestment back into the business, as opposed to being distributed as dividends to stockholders.

As you can see from the above financial statements examples, financial statements are complex and closely linked. There are many accounts in financial statements that can be used to represent amounts regarding different business activities. Many of these accounts are typically labeled “other” type accounts, such as “Other operating expenses, net”. In our financial statements examples, we examined how these accounts functioned for Amazon.

Now that you have become more proficient in reading the financial statements examples, round out your skills with some of our other resources. Corporate Finance Institute has resources that will help you expand your knowledge and advance your career! Check out the links below:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.